Goldquest investigation

Published 16 MAY 2007

Media watchdog condemns CID’s questioning of Morning Leader Editor

[Wednesday, 16 May 2007, 17:19 GMT]

Expressing concern over questioning of Ms. Sonali Samarasinghe, Editor of The Morning Leader, by the Criminal Investigations Department, to reveal the sources of an investigative article, the Free Media Movement (FMM), a Colombo-based Media watchdog, said in a press release that CID’s actions, “not just encroaches the domain of media freedom, but seriously erodes it…Quashing investigative reportage and independent journalism, we clearly see this as another incident wherein the State authorities, despite overt commitments to media freedom, in reality have a callous disregard for it.”

Full text of the press release follows:

The FMM is perturbed to learn that the Criminal Investigations Department (CID) of the Sri Lanka Police questioned the Editor of The Morning Leader, Sonali Samarasinghe, for over four hours today based on a complaint ostensibly under Sri Lankan Monetary Law made by the Central Bank in relation to series of investigative articles published in the Sunday Leader and Irudina news papers last year. The articles she was rigorously questioned on related to the operations of numismatics outfit GoldQuest, the directive of the Central Bank governors to stop the investigation into its activities in Sri Lanka and the publication of the document issuing the directive.

GoldQuest stands accused of operating a form of highly suspect pyramid-scheme in some of the world’s poorest countries. The company, which was based in Hong Kong, sold “commemorative” gold and silver coins and people are encouraged to gain commission by getting more people to sign up. In early May this year, the Jakarta Post in Indonesia reported that Quest International (QI) group Chief Executive Vijayeswaran Vijayaratnam, Director Joseph Bismark, and two other senior executives, Donna Marie Imson and Tagumpay Kintanar were arrested Thursday by the Indonesian police.

As reported by Lanka Business Online on 7th May 2007 on its website though several QI activists were arrested by Sri Lankan police, the Sri Lankan Central Bank dissolved its special investigation unit amidst much controversy in 2006. It is also reported that QI has invested significantly in the Sri Lankan banking sector.

The CID wanted to know the manner in which Sonali Samarasinghe conducted her investigation, the sources of her information, the officials she spoke to and the details obtained with regard to document stopping the GoldQuest investigation. The CID also questioned Ms. Samarasinghe on contacting the then Solicitor General to verify information on the status of the Gold Quest investigation. The CID informed Ms. Samarasinghe that if she did not disclose any of this information, they would inform the Magistrate Court and obtain the necessary directives.

Ms. Samarasinghe declined to give the sources of the information.

Needless to say, the FMM is seriously concerned that the CID, through its actions, not just encroaches the domain of media freedom, but seriously erodes it. This is not the first occasion in which the Police have taken into questioning journalists for pursuing stories that are perceived by those in power to be off limits to media acting in the public interest. This is also not the first occasion that journalists have been intimidated by the Police with requests made to reveal their sources. Ms. Samarasinghe’s right to publish information as she sees fit in her capacity as a professional journalist, is no exception to the cardinal rule of the freedom of expression enjoyed by all citizens, a vital cornerstone in media freedom.

While the FMM would have liked to see the CID and Police extend their fullest support to a public investigation into the dealings of GoldQuest in Sri Lanka, it is perversely not the case. This incident is indicative of the challenges faced by professional media in Sri Lanka today. Quashing investigative reportage and independent journalism, we clearly see this as another incident wherein the State authorities, despite overt commitments to media freedom, in reality have a callous disregard for it.

The FMM requests those in charge of the decision to question Ms. Samarasinghe to make the reasons for their decision to do so public. Recognising the inviolable right of journalists to investigate misdemeanors of public and private institutions and individuals who have embezzled public money, we find it deplorable that the Police have acted in a manner that chills media rights in Sri Lanka. We urge the Police and CID to desist, and remind them that working collaboratively helps strengthen democracy more than antagonizing and threatening journalists.

For more information – (+94) 777 315665

Spokesperson- S. Sivakumar 0777 315665

Convenor – Sunanda Deshapriya ( 0777 312457)

Secretary – Sunil Jayasekara ( 011 2851672/3)

Wrong Target

“We urge the Police and CID to desist, and remind them that working collaboratively helps strengthen democracy more than antagonizing and threatening journalists.”

“The CID wanted to know the manner in which Sonali Samarasinghe conducted her investigation, the sources of her information, the officials she spoke to and the details obtained with regard to documents stopping the Goldquest investigation,” the Free Media Movement said.

“The CID also questioned Ms. Samarasinghe on contacting the then Solicitor General to verify information on the status of the Goldquest investigation.

“The CID informed Ms. Samarasinghe that if she did not disclose any of this information, they would inform the Magistrate Court and obtain the necessary directives.”

“Ms. Samarasinghe declined to give the sources of the information.”

FMM said this was not the first occasion in which the Police have questioned journalists for pursuing stories that are perceived by those in power to be off limits to media acting in the public interest.

“This is also not the first occasion that journalists have been intimidated by the Police with requests made to reveal their sources,” FMM said.

Statement published 27 MAY 2007

http://www.thesundayleader.lk/archive/20070527/news.htm

BASL concerned over questioning of Editor

The Bar Association of Sri Lanka (BASL) has noted with concern the questioning by the Criminal Investigations Department of Editor, The Morning Leader, Sonali Samarasinghe, an attorney-at-law and life member of the BASL, over a series of articles relating to the activities of GoldQuest, a pyramid scheme operating in several countries including Sri Lanka.

“BASL has been informed by Ms. Sonali Samarasinghe that the CID had told her that she should divulge her sources of information and that if she refused to do so it could result in obtaining a magistrate order to get her to do so,” the BASL has said in a statement.

The statement adds, “Such action by the authorities to force journalists to divulge their sources of information is a deterrent to investigative journalism. It is in the public interest that a journalist should obtain information in confidence and publish it to the people. By doing this, the journalist brings to the public notice information, which the public should know. A journalist has the right to expose wrongdoings and neglect of duty, which would otherwise go un-remedied.”

“The recourse to the courts to compel a journalist to divulge the sources of his information is a matter that has been dealt with by the House of Lords in the famous Granada case (British Steel Corporation v. Granada Television (1980) 3WLR 774). What is paramount is the interest of justice and that of public interest.”

BASL also addressed the need for a freedom of information law in the country stating that “A Right to Information Act is a dire need and so is the protection for whistle-blowers, which is an important component and instrument of freedom of expression if people are to provide information without fear of reprisals. It is a strong deterrent against corruption, abuse of power and waste of public wealth,” the BASL said.

“Curtailment of media freedom and freedom of expression goes against the very grain of democratic norms and efforts to bring about transparency in governance by the state, its institutions and also in the private sector.”

“The questioning of a reputed investigative journalist is a wrong signal at a time when media freedom is challenged by various quarters. The Bar Association of Sri Lanka is committed to uphold the freedom of expression and the freedom of press in as much as they are essential for a free and democratic society,” the BASL further states.

_____________________________

Published 5 NOVEMBER 2006 in The Sunday Leader

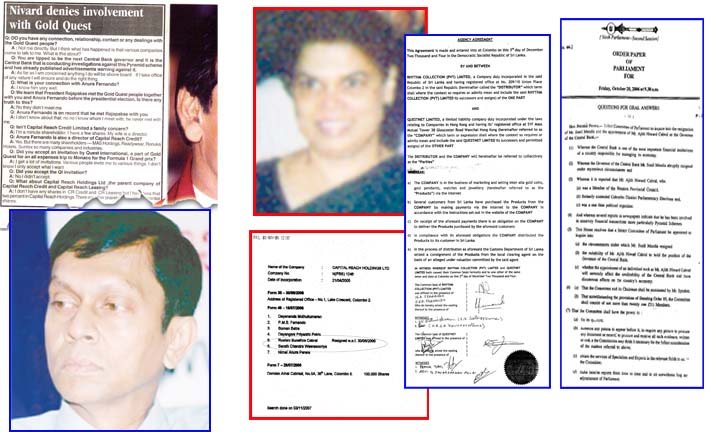

Cabraal does the dirty again

Guilty feet got no Rhythm

Transfers all seven personnel to other departments

Directly stops files reaching AG’s Department

Head, SIU sends internal memo halting all investigations into GoldQuest on Governor’s orders

GQ operatives flourish again as CB castrated by its own head

Uses position to stop wife Roshini from being interrogated by SIU

Gets wife to hastily resign as director of Capital Reach group after The Sunday Leader speaks to him

The Sunday Leader in possession of Agency Agreement between Fernando and Questnet

Parliamentary Select Committee to probe Nivard in the offing

By Sonali Samarasinghe

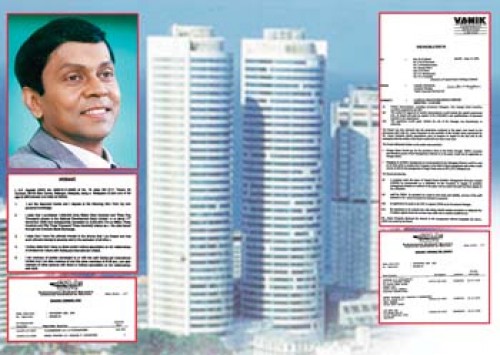

Amid calls for a paliamentary inquiry into his appointment, Governor, Central Bank, Ajith

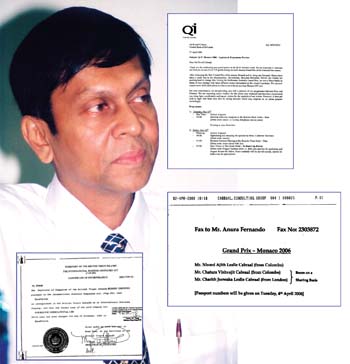

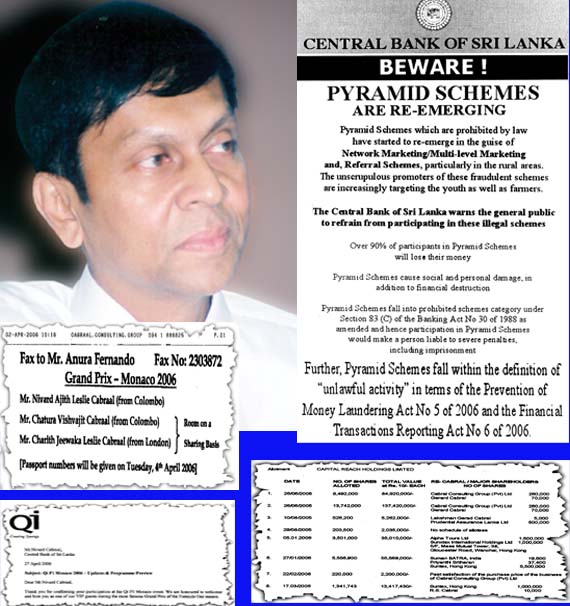

Roshini Cabraal – A director and chairperson of Capital Reach Holdings up to June 30, 2006, Central Bank Governor Ajith Nivard Cabraal.

(Below the picture of Roshinis’) The document of Company search reveals Roshini’s resignation date

Parliamentarians call for Select Committee to probe Cabraal’s appointment as governor

And Agency Agreement between Anura Fernando and Questnet, dated December 3, 2004, are in the picture

Nivard Cabraal has not only quashed the investigations into suspected pyramid marketers Gold Quest in September but also disbanded the entire Special Investigations Unit (SIU) and transferred all the investigators to innocuous departments in the bank.

What is more shocking and incriminates Cabraal further, is that it was just as his wife Roshini Sunethra Cabraal, who was up until June 30, a Director of Capital Reach Holdings Pvt. Ltd., Capital Reach Credit Pvt. Ltd. and Capital Reach Leasing Pvt. Ltd., was to be interrogated by the SIU team that the hurried orders came to have the investigation quashed.

Roshini resigns on cue

Not only that, Cabraal, had her resign as director of all these companies on June 30, 2006, the very day The Sunday Leader first called him to question him regarding the matter. Our first article on GoldQuest and Nivard Cabraal’s connection was published on Sunday, July 2.

Earlier Cabraal had made his wife a Director of these companies with effect from November 26, 2005 in his place after he resigned, in order to take up more lucrative posts in government following Rajapakse’s Presidential victory.

In an interview with The Sunday Leader on June 30 he said on record as follows:

Q: Isn’t Capital Reach Credit Limited a family concern?

A: I am a minute shareholder. I have a few shares. My wife is a director.

However in perhaps one of the most hasty and unwise moves Cabraal has made, he panicked and got his wife to resign from Capital Reach Holdings, Capital Reach Credit and Capital Reach Leasing with effect from June 30, 2006, that is the very day this newspaper first spoke to Nivard and the very day he was intimated of the fact that The Sunday Leader was on his trail.

On July 28, 2005 he then transferred 100,000 shares in the name of his cousin Damien Amal Cabraal of No.5A, 36th Lane, Colombo 8

Anura Fernando, agent for GoldQuest had in one of his numerous statements to the SIU brought up the name of Roshini Cabraal and Capital Reach Holdings. Fernando earlier denied to this newspaper he was an agent for GoldQuest pretending he did not know what we were talking about. However this newspaper is now in possession of the agency agreement appointing Fernando its agent. (See elsewhere on this page for copy of the agreement)

Cabraal recalls team

Cabraal gave orders stopping files which allegedly included incriminating evidence against him in statements and Central Bank reports, en route to the Attorney General’s Department and asked the officers to immediately return to the Central Bank.

Ayesh Ariyaratne ,legal officer, Central Bank Special Investigations Unit together with two others from the unit were on August 29, 2006 taking the files to the Attorney General’s Department to meet Deputy Solicitor General Yasantha Kodagoda when Ariyaratne received a telephone call instructing him to return to base immediately.

It was only about a week before these orders that one of Anura Fernando’s statements had mentioned the name of Cabraal’s wife Roshini. It was following this lead that the unit was preparing to summon Roshini Cabraal for interrogation.

Be that as it may, on the same day, after the team returned having abandoned their trip to the Attorney General’s Department, Head of the Investigations Unit N.J.S.Abeysinghe sent round an internal memo stating that no further investigation or work should be done on GoldQuest save and except routine matters connected with the court case filed by that company.

Abeysinghe however when contacted by The Sunday Leader was tight lipped and seemed terrified of reprisals at least in demeanour as he hemmed and hawed and prevaricated and refused to comment saying he was transferred to another department and was now doing the work assigned to him at this department.(See box for interview).

When confronted with the fact that he had given a call and recalled the SIU team proceeding to a consultation with the AG, he said The Sunday Leader was wrong but when specifically asked if he was denying the existence of a note and the fact that he gave a call he prevaricated saying he was now not in that department and in a different department.

SIU disbanded by Cabraal

This internal memo was noted and minuted by all seven members of the unit. It was immediately afterward that the unit was disbanded.

The seven members of the unit headed by Deputy Director N.J.S. Abeysinghe included Legal Officer Ayesh Ariyasinghe, Legal Officer Enoka Amarasinghe, Accountants Theja Samarasinghe and one Sanjeewa and three sleuths of the CID specially seconded to investigate GoldQuest – ASP Mevan Silva, Chief Inspector Chandana Silva and IP Serasinghe.

AG asked to intervene

Earlier a deputy governor of the Central Bank wrote to the Attorney General requesting his advice on the GoldQuest matter. Central Bank sources told The Sunday Leader that subsequently officers from the SIU visited Solicitor General C.R. de Silva who after consultation requested the officers to take certain steps with regard to the investigation and to return on a specified date.

It was even as the officers led by Ayesh Ariyasinghe legal officer were returning with all relevant files on August 29 to have an extensive consultation with Deputy Solicitor General Yasantha Kodagoda that the unthinkable happened and they were recalled.

Attorney General’s Department sources confirmed that they in fact had opened a file for GoldQuest and as is routine called the officers for a preliminary consultation. However the officers did not arrive on the scheduled date and nothing further had emanated from the Central Bank.

The Sunday Leader separately spoke to Solicitor General C.R. de Silva who said he would have to call for the files and peruse them before he made any comment as he had been out of the island.

Meanwhile it is reliably learnt that following the quashed investigation, GoldQuest has commenced operations all over the island again with secret cells mushrooming in remote villages and operatives swarming everywhere with no fear of reprisals from a Central Bank that has been castrated by its own head.

No conscience

While these hasty moves at the very time the investigation was hotting up only served to compound suspicion in the minds of the investigators, Cabraal continued to act sans conscience as he transferred these investigators willy nilly in order to not only break the back of the investigations but also to send the investigators a sinister message of fear and intimidation. A message, given that the Central Bank pays their salary, they took to heart all too well.

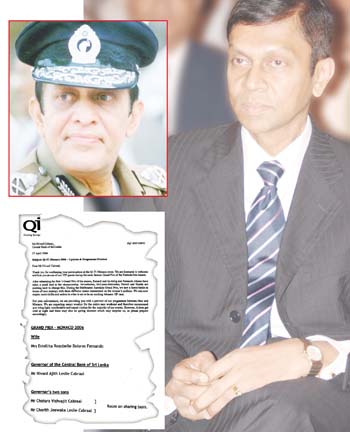

But Cabraal not only transferred the Central Bank employees, he also had three top sleuths of the CID specially seconded to work on the GoldQuest investigation thrown out of the Central Bank SIU, by speaking to his friend former IGP Chandra Fernando.

Fernando who was well known even as the head of police to allegedly wine and dine freely with characters of dubious repute was not expected to act with anything less than bad faith.

The three officers ASP Mevan Silva, Chief Inspector Chandana Silva and IP Serasinghe were earlier seconded to the Central Bank Special Investigations Unit by Chandra Fernando no less on the recommendations of the Attorney General.

All this was before Ajith Nivard Cabraal was appointed Central Bank Governor by President Rajapakse for no other reason than that he crossed over from the UNP and had to be given a chocolate coated cookie as a reward.

CID officers kicked out

However on September 13 as reported in The Sunday Leader, just two weeks after any engagement with the Attorney General was nullified by the Governor, the three CID sleuths were recalled by the former IGP in a letter to the Central Bank stating the prevailing situation in the country and lack of personnel complled him to recall the three officers whose valuable services were needed within the CID.

If their valuable services were needed anywhere, it was to monitor the goings on at the Central Bank itself. And that is exactly why Cabraal wanted them out. Not only that, when they were given their marching orders not even the CID Director Sisira Mendis was intimated of the fact inside sources say.

Cabraal’s dismal performance in the UNP cost him a much desired position and he left the ranks to join the more mediocre of the two groups where competition was almost non existent.

Even before Cabraal took office, The Sunday Leader exposed his links to GoldQuest through an elaborate business network he had set in motion and warned that the investigation will be buried if he assumed the governorship.

Cabraal in GoldQuest net

We revealed an all expenses paid trip to Monaco offered to Cabraal and his two sons by GoldQuest in March this year which he had accepted. It was wheeler dealer Anura Fernando, admittedly a long time buddy of Cabraal who did all the paper work for Cabraal when it came to GoldQuest.

For GoldQuest who had strategically identified and cultivated Nivard Cabraal, they couldn’t have had him in a sweeter spot than as governor of the Central Bank. Already the Central Bank investigation was giving them many a headache. Scores of their operatives were being arrested and the alleged illegal operation was being slowly but surely throttled.

The Sunday Leader has extensively dealt with the GoldQuest issue since June this year and we have proved not only that Cabraal and his companies are connected to pyramid schemes which were outlawed by the Central Bank itself but also that he had a business relationship with GoldQuest, a conglomerate under investigation also by the Central Bank.

Anura Fernando

Furthermore his long time buddy Anura Fernando who was seen carousing and revelling with Nivard at his celebratory party at Mount Lavinia Hotel after the presidential election was the point man and agent for GoldQuest in Sri Lanka.

In fact it was Cabraal who took Anura Fernando to meet Mahinda Rajapakse during last year’s presidential campaign to give the campaign a financial helping hand. Anura Fernando when asked by The Sunday Leader did not deny meeting Rajapakse but said he knew Rajapakse long before GoldQuest.

Funnily enough Anura Fernando denied he was the agent for GoldQuest in June when this newspaper questioned him. “I am not the agent for GoldQuest I don’t know what you are talking about,” he said.

By this time however he had already been questioned and his statement recorded by the Central Bank. In fact the Central Bank was to question him on some 10 separate occasions where Fernando also revealed the names of persons in high places including the wife of Central Bank Governor Roshini Cabraal.

The Sunday Leader is now in possession of the Agency Agreement signed between Rhythm Collections Pvt.Ltd. and Questnet Ltd. appointing Fernando as agent with effect from December 3, 2004.

Agent for GoldQuest

Rhythm Collections was incorporated on September 24, 2004, just three months before Fernando received the agency. (See previous The Sunday Leader articles.) The directors are Nirmal Anura Fernando of No.8 Pelawatte Road, Nugegoda and his wife Estalita Rozabelle Dolores Fernando also of the same address. It was these two who signed the agency agreement. The witnesses to their signatures were K.K.Sathieskumar and H.R.S.A. Karunarathna.

Anura Fernando was to also become the chairman of Ferntea in July. Earlier a 50 percent controlling interest of Ferntea as The Sunday Leader has already revealed in past issues, was bought by Suntex International, a front company for GoldQuest in 2005.

Suntex International Holdings paid Rs. 55,534,109.95 to Ferntea Chairman Jayantha Fernando for 48% of his shares in Ferntea. Ferntea now proceeded to clear goods on behalf of GoldQuest using its name and good offices with the Customs Department.

On another transaction details of which were revealed in The Sunday Leader of July 16, Ferntea owed Jayantha Fernando a sum of Rs. 18 million. However no payment was forthcoming. In the meantime on or about May 10 or 15 this year a huge consignment of gold coins, watches and other products arrived at the airport on behalf of Suntex International. The value including duty and VAT was approximately Rs. 45 million.

Anura made chairman of Ferntea

Usually it was Jayantha Fernando who would do the clearing on Gold- Quest’s behalf. Therefore he now obtained the original clearing documents duly stamped by the bank and paid a sum of Rs. 22-23 million for the goods. However he did not clear the goods by paying duty and VAT of Rs. 22 million.

Instead he told Ferntea now controlled by Suntex International that if he were not paid his Rs. 18 million he would hold on to the original documents and not clear the consignment.

Ferntea immediately summoned and emergency board meeting and Fernando was sacked as chairman of Ferntea in the first week of July this year and Anura Fernando, the GoldQuest agent and CEO of Ferntea was appointed by Suntex and now took over as chairman.

Following The Sunday Leader Exposes all these matters had been revealed to the Central Bank SIU in a number of statements taken from Anura Fernando, Jayantha Fernando and various others connected thereto.

Questnet

Quesnet (see previous The Sunday Leader articles) is actually GoldQuest, a company incorporated in the territory of the British Virgin Islands as an international business company on September 16, 1998. On November 4, 2003 GoldQuest International changed its name to Questnet Ltd. The major shareholder in Questnet is Quest International better known as QI.

Fanfare to no avail

Indeed it was with much fan fare that the government heralded an investigation into the activities of pyramid schemes spending millions of rupees by way of advertisements in newspapers to warn the public of the dangers in falling prey to such schemes.

The controversial network marketing scheme, was deemed illegal in Sri Lanka in early 2005 after the scam drained an estimated US$ 15 million in foreign exchange from the country during the 18 month period it was in operation. The Central Bank then rushed through amendments to the Banking Act, banning pyramid style schemes.

Even seminars were conducted throughout the country to caution the public but little did the unsuspecting public know that the high and mighty themselves had a stake in such schemes. Even legislation was passed in February 2005 to outlaw the practice.

This newspaper with documentation showed that GoldQuest, moving to a grand and systematic strategy, was not only trying to take over the National Development Bank through the country’s stock exchange by resorting to subterfuge and false affidavits but they were also trying to gain control of several of the country’s key financial vertebrae such as the EPF, ETF and the lucrative Mahapola accounts through a network of front companies including companies belonging to Central Bank Governor Ajith Nivard Cabraal.

Background

Nivard Cabraal’s company Capital Reach Holdings was bought into by Suntex International, a front company for GoldQuest. Capital Reach Holdings interestingly enough was only incorporated on April 21, 2005 just four months after Anura Fernando gained agency of GoldQuest in December.

Parliament to probe Nivard

Just three weeks ago on October 20, a large number of UNP MPs called for a select committee of parliament to inquire into the suddent resignation of former Governor Central Bank, Sunil Mendis and the appointment of Ajith Nivard Cabraal.

The committee if appointed would consist of 21 members and would have extensive powers inter alia to summon before it any person or require any person to submit any document or record.

It is in this backdrop that Cabraal’s disgustingly blatant moves to quash the investigation and quell the zeal of the investigators and even dupe the Attorney General’s Department by spiriting away files meant to be discussed with the AG should be viewed. It is President Rajapakse who appointed Cabraal. Therefore his actions will only serve to tarnish the image of the President and his government. If the President does not want to become more unpopular than he already is only one year into his presidency he should learn to discipline his own men.

|

||||

Published 17 SEPTEMBER 2006 in The Sunday Leader

http://www.thesundayleader.lk/archive/20060917/spotlight.htm#Cabraal

Cabraal has the last laugh

The death of another national investigation

By Sonali Samarasinghe

Last Wednesday (13) marked the death of another national investigation which would have

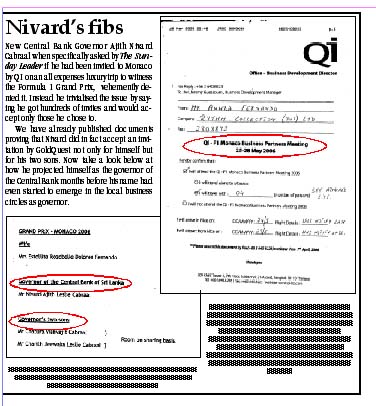

IGP Chandra Fernando, Invitation by QI sent to Cabraal at the Central Bank and Cabraal referred to as ‘Governor’ three months before his appointment and Nivard — keeping a straight face for the public

saved the nation billions of dollars in foreign exchange and possibly Sri Lanka’s economy from being devoured by an international ring of multi level marketers.

It was with much fanfare that the government heralded an investigation into the activities of pyramid schemes spending millions of rupees by way of advertisements in newspapers to warn the public of the dangers in falling prey to such schemes.

The controversial network marketing scheme was deemed illegal in Sri Lanka in early 2005 after the scam drained an estimated US$ 15 million in foreign exchange from the country during the 18 month period it was in operation. The Central Bank then rushed through amendments to the Banking Act, banning pyramid style schemes.

Even seminars were conducted throughout the country to caution the public but little did the unsuspecting public know that the high and mighty themselves had a stake in such schemes. Even legislation was passed in February 2005 to outlaw the practice.

Such was the zeal of the authorities that on the recommendation of the Attorney General, the Inspector General of Police Chandra Fernando no less, seconded three top sleuths from the Criminal Investigations Department to the Special Investigations Unit of the Central Bank to crack the mafia operating the schemes and foisting them on an unsuspecting and gullible public.

The three officers of the CID who were seconded to the Central Bank were ASP Mevan Silva, Chief Inspector Chandana Silva and IP Weerasinghe who got about their task like eager beavers and systematically began to unearth the massive ring that was operating the outlawed pyramid schemes.

All that was before President Mahinda Rajapakse’s blue eyed pet – Ajith Nivard Cabraal ascended the throne at the Central Bank.

We told you so

Even before Cabraal took office The Sunday Leader exposed his links to the pyramid scheme operators through an elaborate business network he had set in motion and warned that the investigation will be buried sooner than later if he assumed the governorship.

Indeed this newspaper even revealed an all expenses paid trip to Monaco offered to Cabraal and his two sons by GoldQuest in March which he had accepted. However due to extraneous reasons he could not keep his date in Monaco.

Ironically at that time when Sunil Mendis was still the governor of the Central Bank and Cabraal’s name had not even publicly surfaced as a possible successor, Quest International alias GoldQuest was to send his invite to the Central Bank describing him as “governor.”

And now just a little over two months after Cabraal took office as Central Bank Governor, the three CID officers have been thrown out on their collective ear on a direct order by the IGP in consultation with the Central Bank.

At the time of their appointment the three officers were seconded for two years to conclude their investigations but hardly a year has lapsed before they were given the marching orders.

Interestingly they were given the marching orders and asked to report back to the CID without any intimation even to the CID Director, Sisira Mendis inside sources said.

In a letter to the Central Bank of Sri Lanka the three CID officers were recalled by IGP Fernando stating the prevailing situation in the country and lack of personnel compelled him to recall the three officers whose valuable services were needed within the CID.

Several arrests

However The Sunday Leader reliably learns that the CID officers were in fact perhaps doing their job too well. When the officers were first seconded, their job was to raid illegal money changing shops and deal with small time financial fraud. However with an increased awareness of pyramid schemes and multi level marketing the trio started investigating several of these schemes and making several arrests.

It was about this time The Sunday Leader learns that the name of Ajith Nivard Cabraal started to appear in several of the investigations. By mid year Cabraal had already taken over as Central Bank Governor even though he had earlier, as Secretary, Plan Implementation, occupied the Central Bank using it as his office.

The Sunday Leader called the Central Bank Special Investigations Unit only to be hastily and fearfully told that the officer was busy.

Considering that it was in fact the Central Bank itself that commenced investigations into pyramid schemes even engaging the media to highlight the dangers of such schemes to the public, the newly acquired fearful attitude of the Central Bank SIU stood out like a tall poppy.

Under intense investigation

The Sunday Leader earlier ran a series of articles in order to assist the Central Bank in its investigations of GoldQuest and other like pyramid schemes that have been under intense Central Bank investigation by the Special Investigations Unit.

Moving to a grand and systematic strategy, this newspaper with documentation showed that not only was GoldQuest trying to take over the National Development Bank through the country’s stock exchange by resorting to subterfuge and false affidavits but they were also trying to gain control of several of the country’s key financial vertebrae such as the EPF, ETF and the lucrative Mahapola accounts through a network of front companies including companies belonging to Central Bank Governor Ajith Nivard Cabraal.

Lucrative government post

Nivard Cabraal’s company Capital Reach Holdings was bought into by Suntex International, a front company for GoldQuest. Nivard on November 26, 2005 resigned from the board of Capital Reach Holdings to take on lucrative government posts but installed his wife Roshini Cabraal in his place as chairperson.

GoldQuest in the meantime having palavered the Governor in luxurious style, has now requested the Appeal Court to direct the Central Bank to determine if GoldQuest’s marketing plan is against Sri Lanka’s banking laws.

The firm has also asked for a writ preventing the bank from prosecuting persons connected with GoldQuest until a determination is made regarding the legality of its marketing plan and for interim relief preventing the Central Bank from prosecuting or seizing its products until the appeal hearing is concluded.

Laws passed

Funnily enough, the Central Bank has already arrested several GoldQuest activists under an anti-pyramiding clause in the said Banking Act after the law was passed in parliament in February of last year.

The Banking Amendment Act No 2 of 2005 certified on February 10, 2005 clearly sets down the law on illegal marketing scams. At least 10 local GoldQuest upliners recruited by the QI group have been arrested – all of them young and vulnerable, the oldest being only 21 years of age.

GoldQuest had filed the petition in the Appeal Court under the name of Questnet International citing the Governor of the Central Bank of Sri Lanka, Ajith Nivard Cabraal, the other members of the Monetary Board, senior officials of the bank’s special investigation unit and Sri Lanka’s Inspector General of Police as respondents.

Call for information

Cabraal is also the head of the Monetary Board. Earlier, Deputy Director, Central Bank Special Investigations Unit, N.J.S. Abeyasinghe admitted to The Sunday Leader the Monetary Board would have access to details of the investigation and had the right to call for any information.

It is in this backdrop that IGP Fernando should have been doubly careful. He should have exercised a modicum of caution before he set about recalling the officers even for innocent reasons given the alleged dealings of Cabraal with businessmen linked to the outlawed schemes.

Such a move even if innocent will serve only to detract from the appearance of a transparent and impartial investigation and create suspicion of a cover up because the investigation was getting too close for comfort.

Published in The Sunday Leader 23 JULY 2006

http://www.thesundayleader.lk/archive/20060723/spotlight.htm

Conflict of interest and the Gold Quest saga

By Sonali Samarasinghe

If you thought the evidence on Gold Quest we provided last week was dynamite, then today

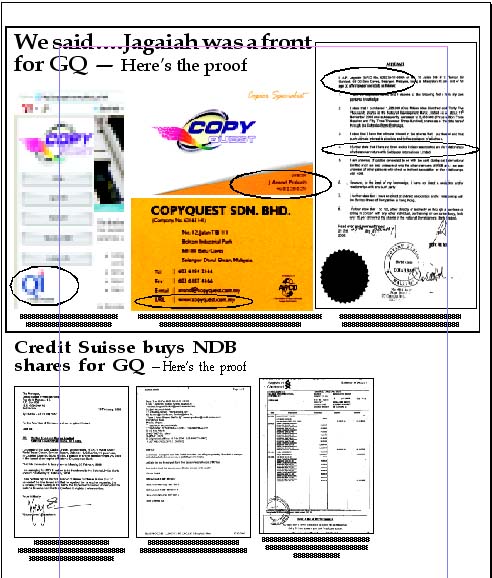

A company search of CopyQuest in Malaysia establishes Gold Quest Chief Vijayeswaran to Jagaiah, CopyQuest company search shows the same address of Jagaiah as that given in his affidavit to NDB, Capital Reach Holdings Limited minutes of 11-04-2006 with excerpts on decision to bid for the management of EPF, ETF, Mahapola etc. , Jagaiah’s affidavit to NDB which has the same address as his Copy Quest address and Nivard Cabraal are in the picture

you’ll be blown out of your seat.

Evidence has now come to light that GoldQuest and A.P.Jagaiah have in fact acted in concert to buy shares of the National Development Bank with company search records now in our possession showing a direct link between Jagaiah, Goldquest and Vijayeswaran, the monarch of the Quest group.

The question is this. The NDB is a public quoted company. What action will the Securities Exchange Commission (SEC) now take to ensure that GoldQuest alias Quest International does not take over one of the country’s assets through the Colombo Stock Exchange in contravention of banking laws?

The more telling question is therefore also this. For ironically, while Ajith Nivard Cabraal ostensibly a friend of the GoldQuest team sits on the Central Bank Governor’s seat, his sister Shiromi sits as a member on the SEC Board.

Indeed it was through Shiromi, who knew Mahinda Rajapakse during Law College days, that Nivard first met the man who was to be President.

Meanwhile, the regulator whether it is the Central Bank, the Securities Exchange Commission, the Colombo Stock Exchange or the Registrar of Companies must be able to act independently in the public interest and in the interest of the long term economic stability of the nation.

All in the family

Funnily enough the regulators themselves are curiously if uncomfortably interconnected. The SEC Chairman is of course Gamini Wickremesinghe, nominated by Cabraal to replace Dr. Dayanath Jayasuriya who was a nominee of Treasury Secretary P.B.Jayasundera. Shiromi Wickremesinghe, Nivard’s sister also sits on the board of the SEC. Apart from Shiromi, D.K. Hettiarachchi, Registrar of Companies is also a SEC member as is Ranee Jayamaha of the Central Bank.

While Hettiarachchi and Cabraal go back a long way, Jayamaha may be compelled to conform to the wishes of her boss.Whether she is made of sterner stuff, we will have to see.

The Chairman of the Colombo Stock Exchange is Nihal Fonseka, CEO of the DFCC Bank and NDB’s primary competitor. Fonseka is also, hold on to your hats, Nivard’s cousin.

Jagaiah further exposed

In the past weeks The Sunday Leader revealed that GoldQuest in their own name bought 10% of the shares of NDB. Apart from that Magandran Rajadurai, Director, International Operations for QI, operating from 5/F Mass Mutual Tower, 38 Gloucester Road, Hong Kong also bought 4.9 % of NDB Bank Ltd. in his own name.

The NDB and NDB Bank Ltd were later merged in August 2005. As at present the GOSL owns 21% of the NDB shares. Of this 21 percent the Bank of Ceylon owns, 14% with the Secretary Treasury, Employees Trust Fund (ETF) and Employees Provident Fund (EPF) holding the rest. GoldQuest in its own name as per the NDB Annual Report 2005 holds 10%. For now recall that The Sunday Leader revealed the following with regard to the NDB:

(1) That according to the Companies Act and Commercial Banking Act a single shareholder cannot hold more than 10 %. It would thus be illegal to hold shares in concert under different names.

(2) That while GoldQuest was buying into NDB, interestingly enough Ravi Thambaiah, owners of Renuka Hotels, Cargo Boat Dispatch etc. were also buying into NDB. In fact on April 26, 2006 Ravi was made a director of the board by virtue of the fact that he was a substantial shareholder. The Renuka Group has 9.68 %. Also interesting is that Ravi Thambaiah is the brother in law of Nivard Ajith Cabraal, Governor of the Central Bank and Chairman of the Monetary Board.Nivard himself was an advisor and director of the Renuka Group.

(3) That the NDB has refused to register the shares of three others on suspicion that they are GoldQuest fronts.

(4) The first of these front names is one A.P.Jagaiah with 9.3% shares which the NDB has refused to register.

(6) The second is Fast Gain International Ltd. with 9.9% shares

(7) And Credit Suisse which has bought a further 9.5% shares through nominee accounts.

Jagaiah’s big lie

Last week The Sunday Leader revealed Jagaiah’s big lie and how he has attempted to dupe the Government of Sri Lanka, the Central Bank regulator and the National Development Bank by even swearing to a false affidavit. (See box)

In his affidavit dated January 27, 2006 he says inter alia:

“I, A.P.Jagaiah (NRIC No.630215-11-5099) of No. 18 Jalan SG 9117 Taman Sri Gombak, 68100 Batu Caves, Selangor Malaysia being a Malaysian citizen and of full age do affirm/swear and state as follows: …

“I further state that I have no direct and/or indirect association and/or relationships of whatsoever nature with GoldQuest International Limited. I am unaware of parties connected to or with the said GoldQuest International Limited and I am also unaware of who the other members of the NDB are. I am also unaware of other persons with direct or indirect association and/or relationships with NDB.”

Smoke screen

In an attempt to create an elaborate smoke screen A.P. Jagaiah calls himself as such to the NDB while going as J.Anand Prakash when dealing in GoldQuest matters. J.Anand Prakash (A.P.J) is in fact the director of Copyquest SDN BHD having its office at No.12, Jalan TIB 1/1, Bolton Industrial Park, 68100 Batu Caves, Selangor Daru Ehsan, Malaysia. Copy Quest as we proved last week is a part of the Quest International Group. (See box)

GoldQuest, Questnet and Quest International are all aliases while Suntex International Holdings Limited is the front company for GoldQuest operating in Sri Lanka. It is through Suntex that GoldQuest bought into the companies owned and managed by Nivard Cabraal and later his wife Roshini.

That J. Anand Prakash alias A.P Jagaiah is inextricably linked to GoldQuest is now abundantly clear.

Smoked out

The company search proves irrefutably that they are one and the same. (See box) It says Anand Prakash A/L Jagaiah and Jaganathan of No.18, Jalan 9/17 Seri gombak 68100 Batu Caves. Note the address given to the Companies Commission of Malaysia by J. Anand Prakash and the address given in the affidavit sworn to by A.P.Jagaiah to NDB. It is one and the same. But one need not look so far to find prima facie evidence of his deception. Just look at the list of shareholders (see box)

(1) Vijayeswaran alias S.Vijayaratnam, the Malaysian national who controls Goldquest owns 199.999 shares of CopyQuest SDN BHD

(2) Anand Prakash A/L Jagaiah alias Jaganathan owns one share.

Therefore now A.P.Jagaiah alias J. Anand Prakash not to mention GoldQuest, stand exposed for acting in concert. And Jagaiah has also got caught lying in a sworn affidavit.

Conflict of interest

It now remains to be seen if the country’s regulators so clearly standing in conflict will act now in the public interest. The main mission of the SEC is to promote, maintain and develop a securities market that is fair, efficient, orderly and transparent. But will the SEC turn a blind eye to the GoldQuest multinational conglomerate under investigation by the Central Bank but attempting to swallow the nation’s economy through the Stock Exchange.

It’s own website states that the Securities and Exchange Commission of Sri Lanka (SEC) was established for the purpose of regulating the securities market in Sri Lanka; to grant licences to stock exchanges, stock brokers and stock dealers who engage in the business of trading in securities; to set up a Compensation Fund and for matters connected therewith or incidental thereto.

The SEC now issues licences to the Stock Exchange, Stock Brokers / Dealers, Unit Trust Management Companies and registers Underwriters, Margin Providers, Credit Rating Agencies, Investment Managers and Securities Clearing Houses.

It is in this respect that the SEC must be doubly careful. Alarming to note is that GoldQuest itself has ideas to take over the EPF and ETF and the Mahapola accounts. (See last week’s Sunday Leader.)

Board minutes

The Sunday Leader had already established that Nivard Cabraal’s Capital Reach Holdings was bought into by Suntex International which is of course a front company for GoldQuest. Nivard on November 26, 2005 resigned from the board of Capital Reach Holdings to take on lucrative government posts but installed his wife Roshini Cabraal in his place as chairperson.

On April 11, 2006, at 9.30 am the board of directors of Capital Reach Holdings met at No. 1, Lake Crescent, Colombo 2. By this time Nivard Cabraal had already agreed to be taken on a luxurious trip to Monaco courtesy Quest International. Roshini Cabraal herself would have known that her own two sons were also scheduled to make the trip later in May. In fact it was her company Cabraal Consulting Group that on April 2 sent the names of her husband and children to Anura Fernando to prepare for the trip. (See previous Sunday Leader newspapers.)

Anyway present at this meeting were Roshini Cabraal, Nivard’s wife as chairperson, Mayura Fernando managing director, Daya Muthukumarana, S.C.Weerasooria and of course Anura Fernando the GoldQuest agent in Sri Lanka and director of Rhythm Collection Pvt Ltd. who were all directors of the company. The minutes stated as follows inter alia: (See box)

MINUTE NO.2006/03/03:

PORTFOLIO MANAGEMENT (B/P 2006/03//01)

“The board was also informed that the projections contained in the paper were based on the discussions held with Mr. Anura Fernando on the portfolio of the foreign client represented by Mr.Anura Fernando (whilst negotiations were in progress in regard to the fee) and on the assumption that the totality of the funds would roll over twice every year.

“The board deliberated further on the matter and noted that – foreign clients should pay for the purchased direct to the broker through SIERA Accounts and therefore passive fund management referred to in the paper would not be applicable to foreign clients. Engaging in portfolio management as recommended by the managing director could be used as an entry point to position the company in the field of fund management and create a track record, to bid for the management of larger funds such as EPF, ETF, Mahapola etc.

The board decided that;

(i) A company under the name of Capital Reach Portfolio Management (Private) Limited (CRPM) be incorporated as a subsidiary of the company to engage in portfolio management business as outlined in the paper with an issued and paid up share capital of Rs.1,000,000.

(ii) Staff for CRPM be recruited on a need to have basis and initially, services of the staff attached to Mr.Anura Fernando be obtained on payment.

(iii) An application be made to the SEC to register CRPM as an investment manager. Mr. Anura Fernando disclosed his interest in the arrangement referred to in paragraph (ii) above, which was noted by the board.”

Anura Fernando’s foreign interest was of course the fact that he was the GoldQuest agent in Sri Lanka. And he was seeking through Capital Reach to control for his foreign account the funds of such local giants as the Mahapola, EPF and ETF.

However will the SEC which states in its own website they are the regulators of fund managers now independently investigate even these minutes?

BOX

Nivard, let’s have a chat

The Sunday Leader dispatched a letter seeking a face to face interview with Nivard Ajith Cabraal, Central Bank Governor – a copy of which was also sent to him by email and fax.

The letter stated Thus.

Dear Mr Cabraal,

Further to the interview we had with you which was published in The Sunday Leader of June 4, we now request a more detailed interview with you where we may be able to put to you any questions of public interest we may have on the ongoing matter of GoldQuest and your involvement with the company and also on any other matters arising therefrom.

We are unable to appreciate your bland statements to other newspapers, which seek to avoid the issue and deal with extraneous and trivial matters of little public interest or value while avoiding the various issues brought up by our newspaper which we have based on documentation in our possession.

Neither can the public accept a blanket statement that your dealings will be above board considering that you do not seem to have acted above board in your dealings with GoldQuest and Quest International.

If you are willing to grant us an interview where we may pose questions to you which you may then obviously answer as you wish, we can assure you that your answers will not be truncated or edited for want of space and you will be afforded as much space as is needed.

Thank you

Sincerely

The Sunday Leader

Published in The Sunday Leader 16 JULY 2006

http://www.thesundayleader.lk/archive/20060716/spotlight.htm

Documentary proof of attempt to take over NDB surfaces

Nivard’s double act and double dealing of Gold Quest

By Sonali Samarasinghe

Incontrovertible new evidence now in our possession has revealed a master plan by GoldQuest to take over the economy of this country.

False affidavits, Swiss Bank accounts and numerous front shareholders accounts to take over

In the right place at the right time but is he the wrong man – Cabraal taking over as Central Bank Governor

control of the NDB reveal that GoldQuest has not only acted mala fides but is also involved in the mother of all conspiracies by a multinational conglomerate to take over a third world economy.

That there is definite bad faith in their dealings giving rise to suspicion about their motives is made amply clear by an affidavit forwarded to the NDB by A.P. Jagaiah, a 9.3% front shareholder for GoldQuest (GQ) in the NDB. Jagaiah swears in the affidavit he has no connection to GQ and calls for his shares to be registered.

However our investigations and even Jagaiah’s own visiting card have proven irrefutably that Jagaiah is not only a front for GQ but GQ has deliberately engaged in bamboozling the Central Bank regulator to hide the fact they are acting in concert together with Jagaiah (See box).

Another front busted

Credit Suisse is another front for GoldQuest that has bought up 9.7% NDB shares. However even stock brokers deny that Credit Suisse is a front for GQ. The Sunday Leader now provides the public, written proof that Credit Suisse is acting for GQ (See box).

Grand plan

Moving to a grand and systematic strategy, documentation shows that not only is this

The Copy Quest web site which identifies itself as part of Qi, Copyquest visiting card of A. P. Jagaiah given as J. Anand Prakash and address which reveals the big lie, Affidavit of A. P. Jagaiah given to NDB denying any connection to GoldQuest, Vijayeswaran’s letter to Credit-Suisse Bank in Switzerland on purchase of NDB shares , Letter confirming opening of account for transferring of money and Ferntea statement of account from Standard Chartered showing Rs. 49.54m deposit are in the picture

multinational conglomerate, trying to take over the National Development Bank through the country’s stock exchange by resorting to subterfuge and false affidavits (see box), but is also trying to gain control of several of the country’s key financial vertebrae such as the EPF, ETF and the lucrative Mahapola accounts through a network of front companies including family companies belonging to Central Bank Governor Ajith Nivard Cabraal (see previous issues of The Sunday Leader).

This is revealed in several confidential documentation and minutes of board meetings as recently as May 2006, held behind closed doors, proof of which are now in The Sunday Leader’s possession.

That the GQ group also known as Quest International (QI) and Quest Net(see previous The Sunday Leader issues) had a stranglehold on Cabraal and was determined to have their man at the head of the all powerful Central Bank is also amply evident.

The Sunday Leader is also in possession of the names of key local leaders GoldQuest likes to call LVTC Leaders (see box) who have been tasked with spreading the financial cancer to the rural areas. These leaders are the key local operators who would manage the scheme at the grass root level to lure in as many recruits as possible. They are the equivalent of the political district organiser.

GoldQuest is even now operating from the Rhythm Collection Pvt. Ltd. office on the 4th floor of No.209/10, Union Place, Colombo 2. Rhythm Collection as established by The Sunday Leader previously is owned by Anura Fernando who is the local agent for GQ/QI.

GoldQuest consignments are now stashed away in an inner room heavily guarded by security guards from KayJay Security Services.

Clandestine methods

Earlier GoldQuest, when banned by the Central Bank in 2005, resorted to more clandestine

Anura Fernando’s fax on Qi letterhead dated March 28th to Jeremy Guessoum, the Business Development Manager of Qi confirming he will be travelling with four others including “Governor of the Central Bank of Sri Lanka” and “Governor’s two sons” for the Qi-F1 Monaco Business Partners Meeting. The public were informed of Cabraal’s appointment only in June. and The second page of Anura Fernando’s letter where reference is made to Cabraal as ‘Governor’ invited to attend Qi-F1 Monaco Business Partners Meeting

methods of using several upliners, independent representatives and promoters who were sent into the rural areas in Sri Lanka to secretly lure the more vulnerable sections of society.

Reliable sources say that poor farmers are now falling ready prey to the get rich quick scheme. Sri Lankan farmers have always been a vulnerable section of society with a high rate of suicide among them. Sources reveal that farmers are now even selling off their tractors in a bid to get rich quick GoldQuest style.

Gold Quest, psychic?

Shockingly, months before even President Mahinda Rajapakse perhaps, knew that Cabraal would be appointed head of the Central Bank, GoldQuest knew. Anura Fernando the front man for GoldQuest in Sri Lanka, in a fax reply dated March 28, 2006 to Quest International referred to Nivard Cabraal as the “Governor of the Central Bank of Sri Lanka” (see box).

Mind you this is three months before Cabraal was appointed and long before the hapless incumbent, Governor Sunil Mendis, probably even knew what fate lay before him.

In an official fax reply document carrying the letterhead of QI, Anura Fernando of Rhythm Collection (Pvt.) Ltd. responded to Jeremy Guessoum, Business Development Manager of QI as follows:

(1) That he confirmed he would attend the QI-F1 Monaco Business Partners Meeting 2006.

(2) That he will be travelling with four persons.

(3) That the names of the four persons would be in the ‘attached list.’

(4) That they would arrive in Nice on May 25, 2006 and depart on May 29, 2006.

QI ‘appoints’ Nivard Governor CB in March

The attached list was included and stated thus -“Governor of the Central Bank of Sri Lanka” – Nivard Ajith Leslie Cabraal, the “Governor’s two sons” Chatura Vishvajit Cabraal and Charith Jeewaka Leslie Cabraal on a room sharing basis and Anura Fernando’s wife Estellita Rozabelle Dolores Fernando, co director of Rhythm Collection Pvt. Ltd.

Note well that the attached list sent to QI by its front man in Colombo and admittedly Nivard Cabraal’s long time buddy, carried the legend ‘Governor of the Central Bank of Sri Lanka’ with reference to Nivard and ‘Governor’s two sons’ in reference to his two male offspring (see box). And that was on March 28, 2006.

Taking over the NDB

The Sunday Leader has already revealed that Gold Quest in their own name bought 10% of the shares of NDB. Apart from that Magandran Rajadurai (see box), Director International Operations for QI, operating from 5/F Mass Mutual Tower, 38 Gloucester Road, Hong Kong also bought 4.9 % of NDB Bank Ltd. in his own name. The NDB and NDB Bank Ltd were later merged in August 2005.

As at present the GOSL owns 21% of the NDB shares. Of this 21 percent the Bank of Ceylon owns, 14% with the Secretary Treasury, Employees Trust Fund (ETF) and Employees Provident Fund (EPF) holding the rest. GoldQuest in its own name as per the NDB Annual Report 2005 owns 9.9% of NDB shares and is the second largest shareholder next to the Bank of Ceylon.

GQ may control EPF, ETF

Alarming is the fact that GoldQuest has already made plans to take control of the EPF and ETF funds giving them control of the GOSL share in NDB as well. But more of that anon.

For now recall that The Sunday Leader revealed the following with regard to the NDB:

(1) That according to the Companies Act and Commercial Banking Act a single shareholder cannot hold more than 10 %. It would thus be illegal to hold shares in concert under different names.

(2) That while GoldQuest was frantically buying into NDB, interestingly enough Ravi Thambaiah owners of Renuka Hotels, Cargo Boat Dispatch etc. were also buying into NDB. In fact on April 26, 2006 Ravi was made a director of the board by virtue of the fact that he was a substantial shareholder. The Renuka group has 9.68 %. Also interesting is that Ravi Thambaiah is the brother in law of Nivard Ajith Cabraal, Governor of the Central Bank and Chairman of the Monetary Board.

(3) That the NDB has refused to register the shares of three others on suspicion that they are GoldQuest fronts.

(5) The first of these front names is one A.P.Jagaiah with 9.3% shares which the NDB has refused to register.

(6) The second is Fast Gain International Ltd. with 9.9% shares

(7) And Credit Suisse which has bought a further 9.5% shares through nominee accounts.

Jagaiah a GoldQuest front

The Sunday Leader now has irrefutable proof that A.P.Jagaiah is in fact a front for GoldQuest. Not only that, this Jagaiah together with the Quest Group has attempted to dupe the Government of Sri Lanka, the Central Bank regulator and the National Development Bank by even swearing to a false affidavit.

In his affidavit dated January 27, 2006 he says inter alia:

“I, A.P.Jagaiah (NRIC No.630215-11-5099) of No. 18 Jalan SG 9117 Taman Sri Gombak, 68100 Batu Caves, Selangor Malaysia being a Malaysian citizen and of full age do affirm/swear and state as follows:

“I state I purchased 1,935,000 (one million nine hundred and thirty five thousand) shares in the National Development Bank Limited on or about November 11, 2005 and subsequently increased to 3,353,300 (three million three hundred and fifty three thousand three hundred) shares as of the date hereof through the Colombo Stock Exchange.

“I further state that I have no direct and/or indirect association and/or relationships of whatsoever nature with GoldQuest International Limited.

“I am unaware of parties connected to or with the said GoldQuest International Limited and I am also unaware of who the other members of the NDB are. I am also unaware of other persons with direct or indirect association and/or relationships with NDB..” (See box for full affidavit)

By the way A.P in Jagaiah stands for Anand Prakash.

Trying to take NDB for a ride

Now comes the subterfuge. Gold Quest used a simple ploy by secret agents throughout the ages and even by JVP elements in the terrible late ’80s. Just as for instance JVP lawyer Wijedasa Liyanarachchi who later died in police custody would call himself L.Wijedasa in the court house, and W. Liyanarachchi in the JVP cell, so did A.P. Jagaiah call himself as such to the NDB while going as J.Anand Prakash when dealing in GoldQuest matters.

J.Anand Prakash (A.P.J) was in fact the director of Copyquest SDN BHD having its office at No.12, Jalan TIB 1/1, Bolton Industrial Park, 68100 Batu Caves, Selangor Daru Ehsan, Malaysia.

Note the similarity in his stated residential address and his official one.

Now it becomes interesting. On the card is a URL www.copyquest.com.my. Go to that URL and A.P.J. is exposed. For the home page clearly says that Copy Quest is part of the QI group. (see box for visiting card of A.P.Jagaiah alias J. Anand Prakash.)

Earlier in fact Jagaiah’s name did appear in the 50 largest shareholder list of the NDB on November 14, 2004. But a month later in December 2004 the NDB now doing due diligence in terms of the banking law took his name off the list on suspicion of being a GoldQuest front. Hence the affidavit denying any connection.

On December 12, 2005 the NDB in writing requested Jagaiah to swear an affidavit he had no connection to GoldQuest. On January 4, 2006 Jagaiah wrote in feigned indignation that NDB had no right to question him under the law and stated without prejudice that he in fact possesses the ultimate interest in the shares and that he did ‘not have a direct association either with GoldQuest International Limited or any other parties, in the manner contemplated by you.’

Two weeks later on January 27, 2006 Jagaiah through his lawyers Rozaidi Read and Co. of Kuala Lumpur while stating that NDB had no right in law to call for an affidavit, however forwards an affidavit. (see box). But now A.P.Jagaiah alias J. Anand Prakash not to mention GoldQuest, stand exposed for acting in concert. And Jagaiah has also got caught lying in a sworn affidavit.

Credit Suisse also a GQ front

The NDB has also not registered the Credit-Suisse Private Banking which has brought 9.7% shares through nominee accounts also on suspicion they were a front for GQ. Well The Sunday Leader now has proof to confirm the NDB suspicions.

Earlier CEO of Asia Capital Asanga Seneviratne who handles the account denied to the Business Section of The Morning Leader that Credit Suisse account was a front for GQ.

We beg to disagree. In fact we have irrefutable proof that it is in fact a front.

We are in possession of a letter written by GQ king pin Vijayeswaran on February 19, 2006 to the Manager, Credit Suisse Private Banking, Rue de la Monnaie 1-3, PO Box 500, 1211 GENEVA 70, Switzerland. Writing to Monsieur Andrea Lomginotti Buitoni the Gold Quest chief man states:

” I understand that Asia Capital Stockbrokers of 22-01, West Tower, World Trade Centre, Echelon Square, Colombo 1, will purchase through the Colombo Stock Market, a tranche of shares representing 9.7% stake in the issued share capital of National Development Bank.

“That this transaction is to take place on Monday 20 February, 2006

“I am arranging for USD 11 million to be transferred to the Catana Limited Bank account on Monday 20 February, 2006

“I also confirm that as the total number of shares purchased is less than 10 percent of the total issued and that no legal opinion is required regarding the purchase of this holding as it is below the 10 percent threshold, above which the National Development Bank may refuse to register the transaction.”

However before this letter of February 19 was sent to Credit Suisse, Vijayeswaran and others at Gold Quest had to arrange for a Catana Limited Bank Account to be opened. Thus Buitoni, on February 16, sent an email to John Challen of the Legal Affairs Department and to Richard Zinkiewicz, the Managing Director of Gold Quest and Quest International. The Cathy he refers to is most probably Cathy Shou of Quest Strategies whose office is also situated in the same premises as GQ in Hong Kong.

Email communication

‘As promised I managed to open Cata (sic) Limited account as I was telling you yesterday. I tried to reach you all, including Cathy, but no success, as probably you are sleeping.

“As Cathy told me, the mony(sic) will flow in from Barclays Personal Account of Mr. Vijay.

“Here are the details that you can pass on to Mr. Vijay and use for the transfer:

Catana Limited

USD Account No. 0251-857920-7

EUR Account No. 0251-857920-72-1″

From these documents it is abundantly clear that Credit Suisse through nominee accounts is in fact holding the shares for GoldQuest (see box).

Money laundering?

Evidence that GoldQuest is also contravening exchange control regulations is apparent from their own documentation.

Here’s how. A 50 percent controlling interest of Ferntea as The Sunday Leader has already revealed in past issues, was bought by Suntex International, a front company for Gold Quest in 2005.

Suntex International Holdings paid Rs. 55,534,109.95 to Jayantha Fernando for 48% of his shares in Ferntea. Then Jayantha Fernando deposited that money back into Ferntea Limited under an investment agreement.

Therefore on May 20, 2005 Jayantha Fernando, Chairman of Ferntea deposited into Ferntea Limited Sri Lankan rupee current account at Standard Chartered Bank, a sum of approximately Rs.55 million through a family company, Carmel Consolidated.

This transaction is reflected in the Ferntea Limited Statement of Accounts of June 1, 2006 of Standard Chartered Bank (see box).

At about the same time Suntex bought another 6% of Ferntea shares through the Colombo Stock Exchange.

On May 26, 2005 that is six days after Jayantha Fernando made his deposit, Suntex International Holdings deposited Rs. 49,540,000.00 in the same SCB Ferntea account.

However this Rs. 49.5 million deposited by Suntex did not appear to have come through a SIERRA account. A Sierra account is Central Bank approved and allows repatriation of funds under exchange control laws.

Therefore this money could not be repatriated. But Suntex which was a front for GQ was now finding ways and means to repatriate these funds to their foreign account. This is revealed in an internal document of Ferntea Limited titled “Options available to Suntex for investing USD 1M in Ferntea.”

The three page document which sets out three options in its last page under ‘notes’ states as follows:

“An amount of USD 500,000 was invested by Suntex into Ferntea in May 2005. As these funds were not invested through the proper channels it cannot be repatriated.”

“A written opinion from the auditors should be obtained confirming that whatever investment path is chosen, the funds can be repaid to Suntex and repatriated from Sri Lanka at a future date.” (See box )

This USD 500,000 is of course the Rs.49.5 million Suntex deposited in Ferntea on May 26, 2005 at an approximate exchange rate of US$ 1=Rs.100.

While a written opinion was being sought on the matter Suntex now decided to enlist Jayantha Fernando’s help to white wash these monies in order that they may repatriate same without contravening the law.

To this end they discussed with Jayantha Fernando the purchase of his Catamaran Hotels belonging to him for a sum of Rs. 100 million where the Rs. 49.5 million deposited in Ferntea by them could be used to set off part of the purchase price.

Thus the money would pass on from business to business. Jayantha Fernando would have none of it and refused to play ball.

Meanwhile recall that Jayantha Fernando had deposited Rs. 55.5 million in Ferntea under an investment agreement which was considered as a loan to the company. The company was paying back Fernando on a staggered basis and also paying him interest on the money every month.

On May 20, 2006, Ferntea now owed Fernando a sum of Rs. 18 million as part of that payment. However no payment was forthcoming. In the meantime on or about May 10 or 15 this year a huge consignment of gold coins, watches and other products arrived at the airport on behalf of Suntex International. The value including duty and VAT was approximately Rs 45 million.

Remember that it was Jayantha Fernando who would usually do the clearing on their behalf. As usual Jayantha now obtained the original clearing documents duly stamped by the bank and paid a sum of Rs. 22-23 million for the goods. However he did not clear the goods by paying duty and VAT of Rs. 22 million.

Instead he told Ferntea now controlled by Suntex that if he were not paid his Rs. 18 million he would hold on to the original documents and not clear the consignment.

Ferntea immediately summoned an emergency board meeting which was objected to by Jayantha Fernando but a board meeting was held anyway and Jayantha Fernando was sacked as chairman of Ferntea last week. Anura Fernando the front man for GoldQuest and CEO appointed by Suntex took over as chairman.

This matter is now before court.

It is however clear that with internal fighting between partners and employees more sordid details will spill out into the open on the workings of GoldQuest.

Deadly board meetings

Now let us come to another frightening aspect of the GoldQuest multinational monster of whose world wide operation we have only seen but a small percentage as yet.

In a nutshell The Sunday Leader had already established that Nivard Cabraal’s Capital Reach Holdings was bought into by Suntex International which is of course a front company for GoldQuest. Nivard on November 26, 2005 resigned from the board of Capital Reach Holdings to take on lucrative government posts but installed his wife Roshini Cabraal in his place as chairperson.

Be that as it may on April 11, 2006, at 9.30 am the board of directors of Capital Reach Holdings was to huddle together at No. 1, Lake Crescent, Colombo 2. By this time Nivard Cabraal had already agreed to be taken on a luxurious trip to Monaco by Quest International. Roshini Cabraal herself would have known that her own two sons were also scheduled to make the trip later in May. In fact it was her company Cabraal Consulting Group that on April 2 sent the names of her husband and children to Anura Fernando to prepare for the trip (see box).

Anyway present at this meeting were Roshini Cabraal, Nivard’s wife as chairperson, Mayura Fernando managing director, Daya Muthukumarana, S.C.Weerasooria and of course Anura Fernando who were all directors of the company.

In attendance was also Anusha Wijesinghe representing the Company Secretary Vanik Corporate Services Ltd.

The minutes stated as follows inter alia:

MINUTE NO.2006/03/03:

PORTFOLIO MANAGEMENT (B/P 2006/03//01)

“The board was also informed that the projections contained in the paper were based on the discussions held with Mr. Anura Fernando on the portfolio of the foreign client represented by Mr.Anura Fernando (whilst negotiations were in progress in regard to the fee) and on the assumption that the totality of the funds would roll over twice every year.

“The board deliberated further on the matter and noted that –

Foreign clients should pay for the purchased direct to the broker through SIERA Accounts and therefore passive fund management referred to in the paper would not be applicable to foreign clients.

Engaging in portfolio management as recommended by the managing director could be used as an entry point to position the company in the field of fund management and create a track record, to bid for the management of larger funds such as EPF, ETF, Mahapola etc.

The board decided that

(i) A company under the name of Capital Reach Portfolio Management (Private) Limited (CRPM) be incorporated as a subsidiary of the company to engage in portfolio management business as outlined in the paper with an issued and paid up share capital of Rs.1,000,000.

(ii) Staff for CRPM be recruited on a need to have basis and initially, services of the staff attached to Mr.Anura Fernando be obtained on payment.

(iii) An application be made to the SEC to register CRPM as an investment manager.

Mr. Anura Fernando disclosed his interest in the arrangement referred to in paragraph (ii) above, which was noted by the board.”

Anura Fernando whose foreign interest was of course the fact that he was the GoldQuest agent in Sri Lanka. And he was seeking through Capital Reach to control for his foreign account the funds of such local giants as the Mahapola, EPF and ETF.

Conflict most foul

Meanwhile in a grotesque twist, GoldQuest last week sought relief from the Appellate Courts seeking an opportunity to explain its position to the Central Bank. A bank now governed by their friend Nivard Ajith Cabraal. To GoldQuest who had engineered the move the timing could not have been sweeter.

Nivard must be accountable

Having palavered the Governor in luxurious style, GQ now requested the Appeal Court to direct the Central Bank to determine if GoldQuest’s marketing plan is against Sri Lanka’s banking laws. The firm has also asked for a writ preventing the bank from prosecuting persons connected with GoldQuest until a determination is made regarding the legality of its marketing plan and for interim relief preventing the Central Bank from prosecuting or seizing its products until the appeal hearing is concluded.

Funnily enough, the Central Bank has already arrested several GoldQuest activists under an anti-pyramiding clause in the said Banking Act after the law was passed in parliament in February of last year. The Banking Amendment Act No. 2 of 2005 certified on February 10, 2005 clearly sets down the law on illegal marketing scams.

GoldQuest has filed the petition in the Appeal Court under the name of Questnet International citing the Governor of the Central Bank of Sri Lanka Ajith Nivard Cabraal, the other members of the Monetary Board, senior officials of the bank’s special investigation unit and Sri Lanka’s Inspector General of Police as respondents.

Cabraal is also the head of the Monetary Board.

Earlier Deputy Director of the Central Bank Special Investigations Unit, N.J.S. Abeyasinghe admitted to The Sunday Leader the Monetary Board would have access to details of the investigation and had the right to call for any information.

Strategy fulfilled

Indeed it was one of the power grabbing strategies of GoldQuest when dealing with third world countries to capture the vital political or business contact rather than the business itself.

Operating like a well oiled secret mafia reliable sources told The Sunday Leader its pivotal figure, Malaysian national Vijayeswaran would urge their fund managers and stock brokers to buy into ailing companies to gain control not only of the company but also of those locals within the company.

Exactly the strategy used by GoldQuest when it bought into local companies Ferntea and more particularly Cabraal’s family company – Capital Reach Holdings(see previous issues of The Sunday Leader newspaper).

Circumventing the law

Recall that GoldQuest and its marketing schemes ran into dire straights in Sri Lanka in early 2005. In February after parliament made the scheme illegal by an Act and the CB set up several units to investigate and stifle their financial activity through credit card transactions and bank accounts, GoldQuest decided to overcome the stringent new laws and come in through the Stock Exchange.

Nivard to the rescue?

It is about this time that a curious coincidence is recorded. Capital Reach Holdings, a new company was incorporated by Nivard Cabraal only on April 21, 2005. After which Capital Reach holdings set up two subsidiaries to take over the ailing Vanik Factors and Vanik Leasing by changing the names to Capital Reach Credit and Capital Reach Leasing respectively. It was only a few months later that GoldQuest front company Suntex International Pvt. Ltd. started frantically buying into the company. Not only that they took over control of Ferntea Pvt. buying over 50 % shares also at about the same time.

They now used Ferntea goodwill and import export mechanism to bring in their gold coins and other numismatics products into the country. Once they utilised Ferntea as a clearing agent for these goods they were handed over to GoldQuest agent in Sri Lanka Anura Fernando whose Rhythm Collection outlet now took over the goods for distribution.

The country can ill afford the mala fide machinations of multi national conglomerates at a time the economy is all but ruined.

In this backdrop it is President Mahinda Rajapakse as Chief Executive and Minister of Finance who must take responsible action to protect the nation from unscrupulous elements be they potential ‘investors’ or his own appointees.

| The LVTC LeadersHere are the names of the local leaders responsible for spreading the illegal marketing scheme through secret cells and closed door seminars especially in the rural areas in order to attract least attention. The Sunday Leader is also in possession of the telephone numbers, email addresses of the following persons.Jag of Colombo 5, Bharathi, Lakshman of Madiwela Kotte, Malinga of Colombo, Chamal, Nirosha, Rajan, Priyantha, Asoka, Arjun and Sandamali Premathilaka who also works at the Rhythm Collection office in Sri Lanka.Ironically Rhythm is an anagram for Rate Yourself To Help Mankind coined by none other than Vijayeswaran himself.Why GoldQuest is illegalGoldQuest, the controversial network marketing scheme, was deemed illegal in Sri Lanka in early 2005 after the scam drained an estimated US$ 15 million in foreign exchange from the country during the 18 month period it was in operation. The Central Bank then rushed through amendments to the Banking Act, banning pyramid style schemes.